top of page

Blog & Insights

Brazil’s Complementary Law No. 227/2026 and Its Impact on Inheritance and Gift Taxation (ITCMD).

Complementary Law No. 227/2026, enacted as part of the regulatory framework implementing Constitutional Amendment No. 132/2023, establishes nationwide tax guidelines and introduces structural adjustments to Brazil’s constitutional tax system. Among its provisions, the law sets forth general rules applicable to the Tax on Inheritance and Gifts (Imposto sobre Transmissão Causa Mortis e Doação – ITCMD), a state-level tax with growing relevance for individuals holding assets or c

Jan 262 min read

Brazilian Federal Revenue Service Guidance on High-Income Taxation and Dividend Withholding.

The Brazilian Federal Revenue Service has released the document entitled “Questions and Answers: High-Income Taxation”, the purpose of which is to provide interpretative guidance on certain aspects of the recently enacted legislation applicable to taxpayers with high levels of income. The document places particular emphasis on the tax treatment of dividends, setting forth, in descriptive terms, the application of a 10% tax rate, the transitional rules applicable to profits ac

Dec 17, 20253 min read

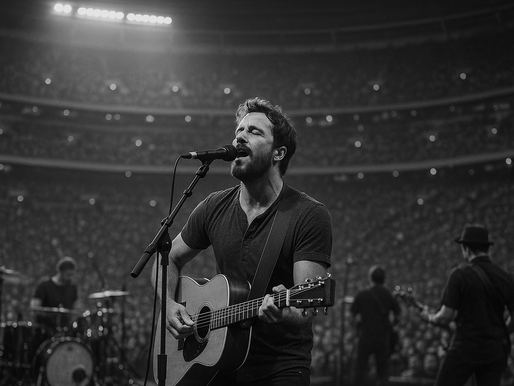

The tax implications of an international artistic career: technical, structural, and strategic considerations.

The globalization of artistic activity, whether in music, performing arts, audiovisual production, sports, or entertainment more broadly, brings with it a complex array of cross-border tax implications. Artists operating internationally are exposed to multiple tax jurisdictions, distinct sources of income, multinational contractual arrangements, intermediary entities, and occasionally conflicting residency rules. Within this intricate environment, the role of a specialized ac

Nov 26, 20255 min read

bottom of page